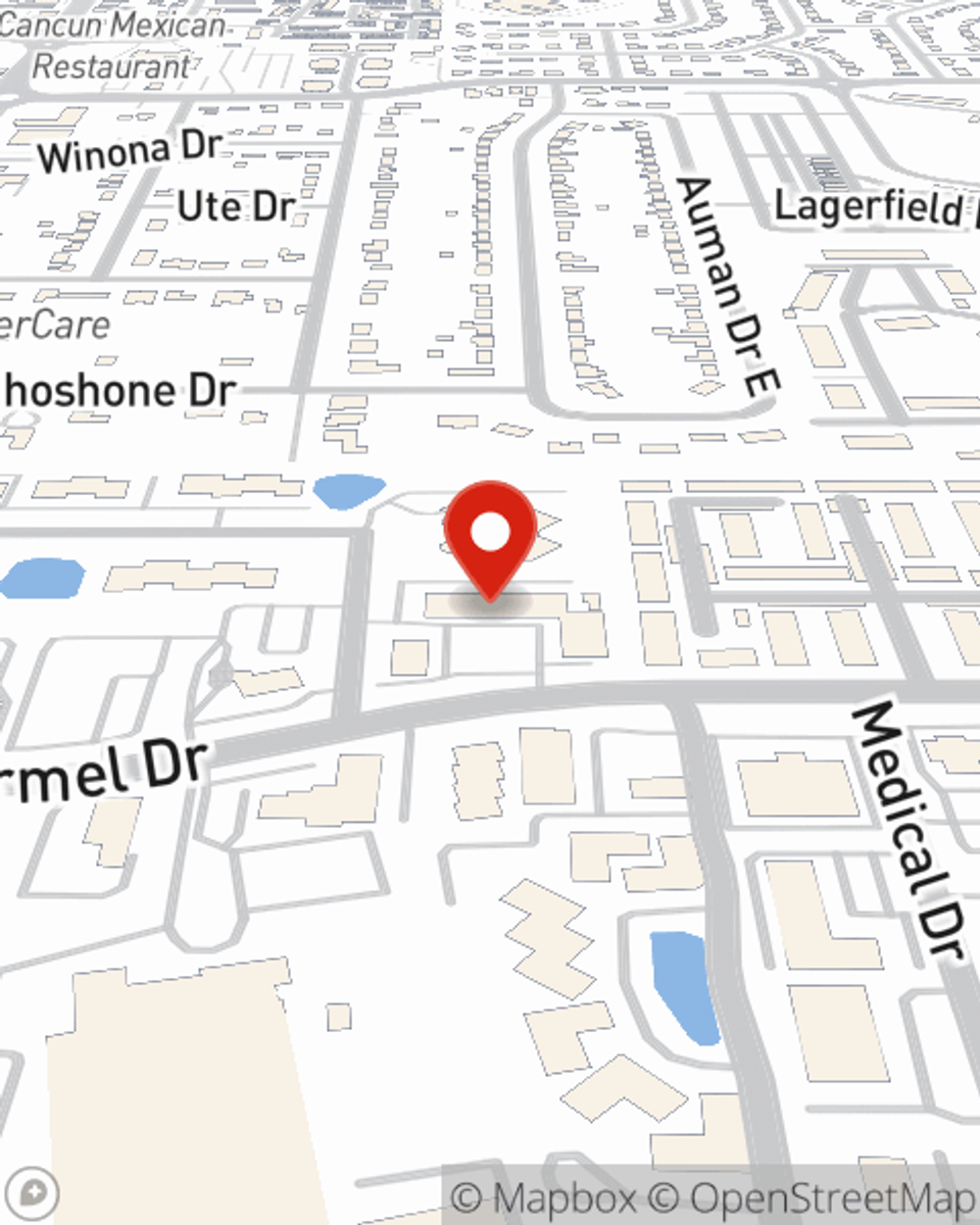

Homeowners Insurance in and around Carmel

Looking for homeowners insurance in Carmel?

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Indianapolis

- Avon

- Broad Ripple

- Brownsburg

- Carmel

- Castleton

- Fishers

- Geist

- Greenwood

- Irvington

- Meridian Kessler

- Noblesville

- Nora

- Plainfield

- Speedway

- Westfield

- Zionsville

- Hamilton County

- Marion County

Welcome Home, With State Farm Insurance

One of the most important steps you can take for your family is to get homeowners insurance through State Farm. This way you can unwind knowing that your home is protected.

Looking for homeowners insurance in Carmel?

The key to great homeowners insurance.

Agent Elizabeth Marshall, At Your Service

From your home to your favorite hobbies, State Farm has insurance coverage that will keep your valuables secure. Elizabeth Marshall would love to help you feel right at home with your coverage options.

When your Carmel, IN, house is insured by State Farm, even if the unexpected happens, your most valuable asset may be protected! Call or go online today and discover how State Farm agent Elizabeth Marshall can help you protect your home.

Have More Questions About Homeowners Insurance?

Call Elizabeth at (317) 844-6300 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Elizabeth Marshall

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.